How Pre-IPO Funding Helps

- Strengthens financial position

- Accelerates expansion and technology adoption

- Enhances brand visibility and investor confidence

- Covers IPO-related expenses including legal, compliance, and marketing costs

Listing your company is much like climbing Everest, challenging, demanding, and transformative, with the right guide, however, the summit is well within reach. We at ASB Growth Ventures, partner with ambitious SMEs to help them transition confidently from private enterprises to listed companies, as SEBI-Registered Category, we deliver end-to-end SME IPO consulting services, ensuring clarity, compliance, and confidence at every milestone of your IPO journey.

Backed by deep domain expertise, a strong investor network, and a client-first philosophy, ASB Growth Ventures is your trusted SME IPO eligibility consultant and strategic growth partner.

From pre-IPO readiness assessment to ringing the listing bell, our team manages the entire IPO lifecycle with precision and accountability.

We specialize in pre-IPO funding and IPO fundraising, helping businesses strengthen their balance sheets and enhance valuation before going public.

We prioritize compliance, ethics, and clear communication, building long-term trust with promoters, regulators, and investors.

Every SME is unique. Our strategies are tailored to your business model, growth plans, and sector dynamics.

Gain access to a wide base of institutional investors, HNIs, financial institutions, and industry stakeholders across India.

Our dedicated team brings deep expertise in IPO regulations, SME listings, corporate finance advisory, and capital markets.

Your business objectives define our roadmap. We align every decision with your long-term growth vision.

Before the “Bell Ringing” ceremony, we must ensure your foundation is rock-solid. Navigating the SME IPO eligibility landscape requires a keen eye for detail. As your consultant for SMEs, we evaluate your readiness based on the stringent guidelines of NSE Emerge and BSE SME.

ASB Growth Ventures works closely with your CA firm in Mumbai or chartered accountant in Bhopal to ensure complete financial and regulatory readiness.

Raise funds to accelerate innovation, expand operations, adopt new technologies, or pursue strategic acquisitions.

A listed status strengthens your reputation among customers, suppliers, lenders, and partners.

Enjoy diversified funding options and improved negotiating power with financial institutions.

Provide exits to early investors and create opportunities for ESOPs to boost employee engagement.

Equity-based incentives align employees with your company’s long-term growth.

Transitioning from an unlisted to a listed company is a pivotal milestone, with ASB Growth Ventures as your Merchant Banker and Lead Manager, the journey becomes strategic, structured, and seamless.

We manage complexities so you can stay focused on running your business.

Our services offers tailored pre-IPO funding solutions designed to prepare your business for a successful listing.

Our services extend beyond IPOs, positioning ASB Growth Ventures as a leading corporate finance advisory firm in India, with presence and expertise across Mumbai, Delhi, and Hyderabad.

We frequently collaborate with chartered accountants in Mumbai, CA firms in Mumbai, and corporate finance advisory teams in Hyderabad to deliver integrated solutions.

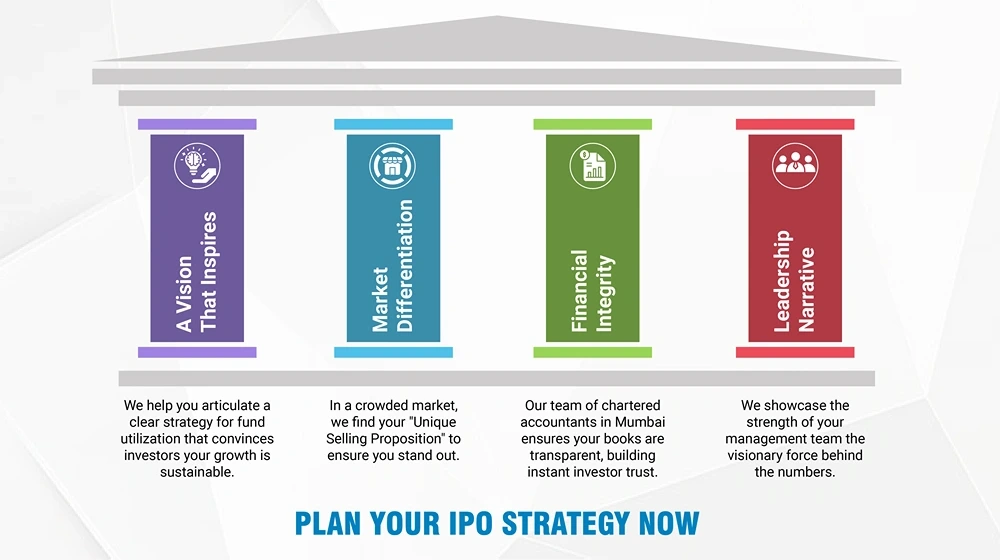

We don’t just guide you through the IPO process—we propel you towards unparalleled success. Our SME IPO service is designed to be the rocket fuel your business needs to soar. We understand the intricacies of taking your small or medium enterprise public, and we tailor our approach to ensure your unique story captivates investors and stakeholders alike.If you’re ready to transform your ambition into a listed success story, let’s get started.